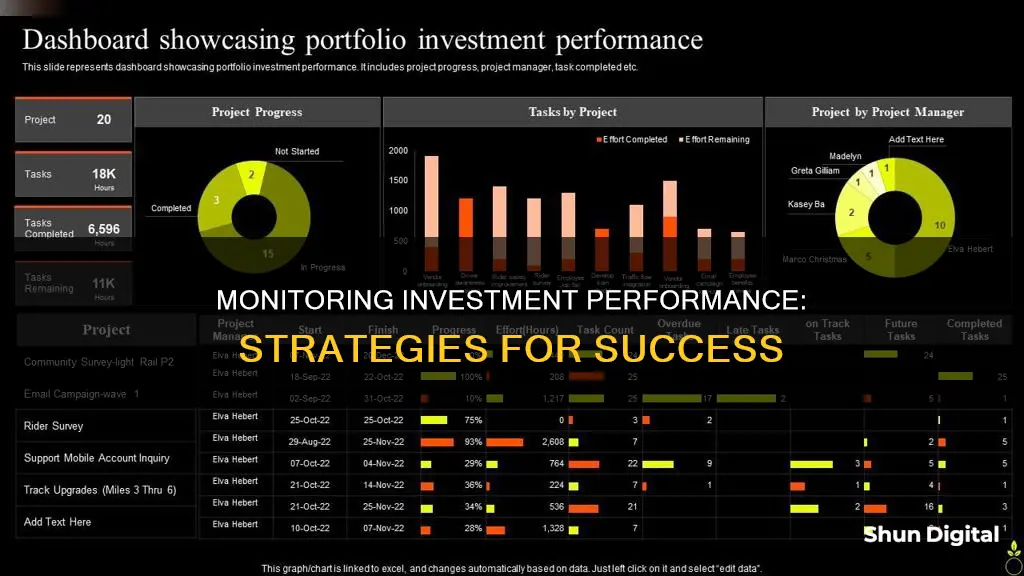

Monitoring the performance of your investments is a critical part of managing your assets. While it doesn't need to be done incessantly, it's important to keep track of your investments to know how well they're doing and to help you make better decisions. There are several ways to do this, including using portfolio management apps, checking stock tables, and comparing your investments against benchmarks.

| Characteristics | Values |

|---|---|

| Frequency of evaluation | A yearly evaluation of your investments, at roughly the same time each year, is often enough. |

| Sources of information | Consolidated statements from a single financial services firm, or multiple statements from different firms, online access to account information, account information by phone |

| Performance measures | Yield, rate of return, transaction fees, taxes, inflation, rebalancing |

| Tools | Portfolio tracker apps, master spreadsheet, FINRA’s Fund Analyzer, annual and total return calculators |

| Mutual fund performance | Compare to other funds, use resources like Globefund or Morningstar, review disclosure documents, consult your advisor, follow stock market and general economic news |

| Stock performance | Review account statements, check stock tables, compare against benchmarks, get current news on companies, consult your advisor, follow stock market and general economic news, use indicators to re-assess investment decisions |

What You'll Learn

Compare against benchmarks

Benchmarks are a standard or measure used to analyse the allocation, risk and return of a given portfolio. They are a useful tool for investors to gauge the overall health of large public markets and understand how their portfolio is performing against various market segments.

Choose the portfolio or account to be measured

If you want to review how your investments are performing compared to a managed portfolio or an investment advisory service, it may be useful to segment your portfolios. You could, for example, measure the performance of one account, such as a 401(k) account, or a collection of accounts, such as retirement accounts that include a 401(k), IRA, Roth 401(k), and Rollover IRAs.

Consider the asset allocation

Next, consider the asset allocation of the portfolio. Investments can be categorised into asset classes (e.g. stocks, bonds) or sub-classes (e.g. large-cap stocks, mid-cap stocks). For each asset class or sub-class, there is an associated percentage of assets. For example, the asset allocation of a retirement portfolio could be 65% large-cap US stocks, 25% international stocks, 5% US bonds, and 5% cash.

Identify appropriate benchmarks

You will then need to identify appropriate benchmarks to compare the performance of your portfolio with the expected performance. The main idea is to match your groupings of investments to an appropriate index. For example, you could match large-company stocks in the US to the S&P 500, while US bonds could be matched with the Bloomberg Barclays US Aggregate Bond Index.

There are many indexes to choose from, including:

- Large-cap US stocks: S&P 500

- Small-cap US stocks: S&P SmallCap 600 or MSCI USA Small Cap

- International stocks – developed countries: S&P Developed Ex-U.S. BMI or MSCI World

- International stocks – emerging countries: MSCI Emerging Markets

- US bonds: Bloomberg Barclays US Aggregate Bond Index

- International bonds: Bloomberg Barclays Global Aggregate Bond Index

- Real Estate: S&P United States REIT or S&P Global REIT

Calculate actual vs benchmark portfolio performance

Now, calculate the performance of your portfolio and that of its benchmarks. For example, if your retirement portfolio has grown by 10%, you can compare this to the performance of relevant benchmarks during the same period.

Rebalance as needed

By comparing your portfolio's performance against benchmarks, you can identify when adjustments need to be made. This process is known as rebalancing and can help ensure your portfolio remains aligned with your investment goals and risk tolerance.

Dead Pixels: RMA Criteria for ASUS Monitors

You may want to see also

Monitor fees and expenses

Monitoring fees and expenses is an important part of tracking your investment performance. Fees and expenses reduce your fund's returns, so it's important to understand how they work and how they impact your investments. Here are some ways to monitor and manage fees and expenses:

- Use a Portfolio Tracker App: Many mobile investment apps offer features to help you monitor fees and expenses. For example, the Empower app (formerly known as Personal Capital) has a feature that monitors the costs of your investments, including mutual fund fees. It also allows you to track performance, asset allocation, and fees using easy-to-read graphs and charts.

- Review Account Statements: Regularly reviewing your account statements can help you keep track of the costs you're paying. This includes fees such as brokerage and mutual fund fees, as well as transaction fees. By reviewing your statements, you can identify how these fees impact your overall investment performance.

- Utilize Mutual Fund Fee Calculators: If you invest in mutual funds, use a mutual fund fee calculator to understand how fees and other costs affect your returns. These calculators can help you make informed decisions about your mutual fund investments.

- Compare Performance Against Benchmarks: Compare the performance of your investments against relevant benchmarks, such as market or sector indices. This will help you identify if your investments are underperforming relative to the market or a specific sector. If a stock consistently underperforms its index, it may be a warning sign.

- Analyze Financial Indicators: Familiarize yourself with financial indicators that can help assess the value and growth potential of stocks. For example, the price-to-earnings (P/E) ratio can indicate whether a stock's price is high or low compared to its earnings. Other indicators include the price-to-earnings-growth (PEG) ratio, price-to-book (P/B) ratio, dividend payout ratio (DPR), and dividend yield.

- Stay Informed with News and Disclosure Documents: Keep up with stock market news and general economic news to understand how broader market trends and economic factors may impact your investments. Additionally, review disclosure documents from the companies you've invested in, as they can provide valuable information about the company's performance and any changes that may affect your investment.

Measuring Your Monitor: A Step-by-Step Guide to Sizing

You may want to see also

Review account statements

Reviewing account statements is a crucial aspect of monitoring your investment performance. Here are some detailed instructions and considerations to keep in mind when reviewing your account statements:

Understanding Account Statements:

Account statements provide valuable information about your investments and their performance. These statements can be obtained from your financial services firm or brokerage, either through regular mail, online access, or sometimes over the phone. They typically include details such as the current value of your investments, transaction history, and associated costs or fees. Understanding these statements is essential for evaluating your investment performance and making informed decisions.

Tracking Costs and Fees:

Keep a close eye on the costs associated with your investments. Account statements will outline various fees, such as transaction fees, management fees, and operating expenses. These fees can eat into your returns, so it's important to be aware of them and assess whether they are reasonable and aligned with the services provided. Consider using a fee calculator to understand better how these fees impact your overall returns.

Performance Evaluation:

When reviewing your account statements, compare the performance of your investments against your financial goals and guidelines outlined in your investment policy statement (if you have one). Evaluate whether your investments are meeting your expectations and contributing to your overall financial objectives. Are your investments generating the desired returns, or are they underperforming relative to your benchmarks? This analysis will help you identify areas that may require adjustments or rebalancing.

Benchmarking:

Utilize benchmarks such as market indices (e.g., S&P 500, S&P/TSX) or sector indices to compare the performance of your investments. Benchmarking helps you contextualize how your investments are doing relative to the broader market or specific sectors. If your investments consistently underperform their respective benchmarks, it may be a cause for concern and a signal to reconsider your investment strategy.

Monitoring Progress:

Regularly review your account statements to track the progress of your investments over time. Look for steady growth in your portfolio value, even if individual investments may experience fluctuations. Assess how your investments have performed over different periods, including short-term and long-term horizons. This will help you identify trends and understand the impact of market conditions on your investment performance.

Consolidating Information:

If you have investments with multiple financial firms or various account types, consider creating a master spreadsheet that consolidates information from all your account statements. This comprehensive overview will give you a clear picture of your entire investment portfolio, allowing you to track progress, identify discrepancies, and make more informed decisions affecting your overall financial strategy.

Identify Pixels: Monitor Troubleshooting Guide

You may want to see also

Consult your advisor

Consulting a financial advisor is a great way to gain a deeper understanding of your investments. If you have an advisor, they can explain any sudden price changes and what that means for your portfolio. For example, if you have stocks, ask your advisor why prices have suddenly fallen or risen and what the implications are for your stock portfolio.

If you have all your investments with a single financial services firm, you may receive consolidated statements that contain information about all your accounts. However, if you have accounts with several different firms, or both tax-deferred and taxable accounts, you may need to look at several different statements to get a complete picture of your total portfolio performance. Many firms provide online access to your account information, so you can look up the latest values for your holdings at any time. You may also be able to access your account information by phone.

Your advisor should be able to provide you with a copy of the Fund Facts, which is a user-friendly guide that outlines key information about your mutual fund, including fees and performance. They can also help you understand how your mutual fund is performing relative to other similar funds. They will be able to compare your fund's performance against a relevant benchmark, such as a market or sector index, that tracks a group of selected investments.

Your advisor will be able to explain the role of transaction fees and taxes on performance, as well as the impact of inflation on your long-term investments. They can also help you rebalance your portfolio when necessary and ensure your investments are aligned with your financial goals.

Asus Monitor Manufacturers: Who Makes These Devices?

You may want to see also

Follow stock market news

Following stock market news is an essential part of monitoring your investment performance. Here are some detailed and direct instructions on how to do this:

News Sources

There are numerous news sources to choose from, and it is beneficial to use a variety of them. Local, national, and international news sites will all offer different perspectives and cover a range of markets. Examples of 24/7 news coverage providers include CNN, BBC, The New York Times, Reuters, and The Globe and Mail.

Newsletters and Social Media

Many news sources also offer daily newsletters that you can subscribe to, as well as a social media presence. Following these accounts can help you stay informed. For example, you can follow CNBC on social media and also subscribe to their newsletters to receive the latest financial news and trends.

News Tickers

Some news sites offer downloadable programs that run a news ticker along the top or bottom of your computer screen. This feature often appears on your brokerage trading pages if you are an active trader. You can usually customize these tickers to display specific news categories, such as business news. This allows you to monitor news headlines passively while working on other tasks.

Podcasts

If you prefer listening to the news, podcasts are a great option. You can download audio updates of breaking news and investing trends to your smartphone and listen to them at your convenience. While this format may be better suited for long-term investors, many of these podcasts focus specifically on financial news.

Customized Alerts

Google Alerts and Feedly are examples of services that provide customized alerts. You can select specific subjects or keywords to follow, and these sites will scan the internet for news from various sources, including blogs, newsletters, and social media. For instance, you can set an alert for "drought food prices" to stay informed about the impact of droughts on food prices.

Social Media

Many companies release important news on their social media platforms, such as Twitter, Facebook, Instagram, and YouTube. By following these accounts, you can stay updated on changes that may impact your investments. You can also use social media to follow finance experts, the stock market, or specific industries in which you invest. These experts often predict changes or notice trends before official company announcements.

Mobile Apps

Mobile investment apps, such as Empower (formerly Personal Capital) and SigFig Wealth Management, offer real-time information on your investments. These apps can sync with your existing accounts, provide retirement tracking and planning, and measure your portfolio's performance against benchmark indices.

By utilizing these tools and staying informed about stock market news, you can make more informed decisions regarding your investments.

Removing Biotel Monitors: A Step-by-Step Guide for Beginners

You may want to see also

Frequently asked questions

A yearly evaluation of your investments, at roughly the same time each year, is often enough to keep you engaged in your holdings while tracking the progress of your investment goals.

Some common ways to measure performance include yield, rate of return, and annualized return. Yield is typically expressed as a percentage and measures the income generated by an investment over a specific period. Rate of return calculates all the money made or lost on an investment, while annualized return compares the performance of investments held for different periods of time.

Some tips include factoring in transaction fees, creating a single spreadsheet for all your investments, considering the impact of taxes and inflation on returns, and comparing returns over several years to identify patterns.

You can use resources like Globefund or Morningstar to compare your mutual fund's performance against other similar funds and relevant benchmarks, such as the S&P 500 Index. Additionally, review account statements, consult your financial advisor, and stay informed about stock market and general economic news.

Review your account statements, compare stock tables and performance against benchmarks, and stay informed about the companies you've invested in and stock market news. Utilize financial indicators such as Earnings Per Share (EPS) and Price to Earnings (P/E) ratio to assess the value and growth potential of stocks.