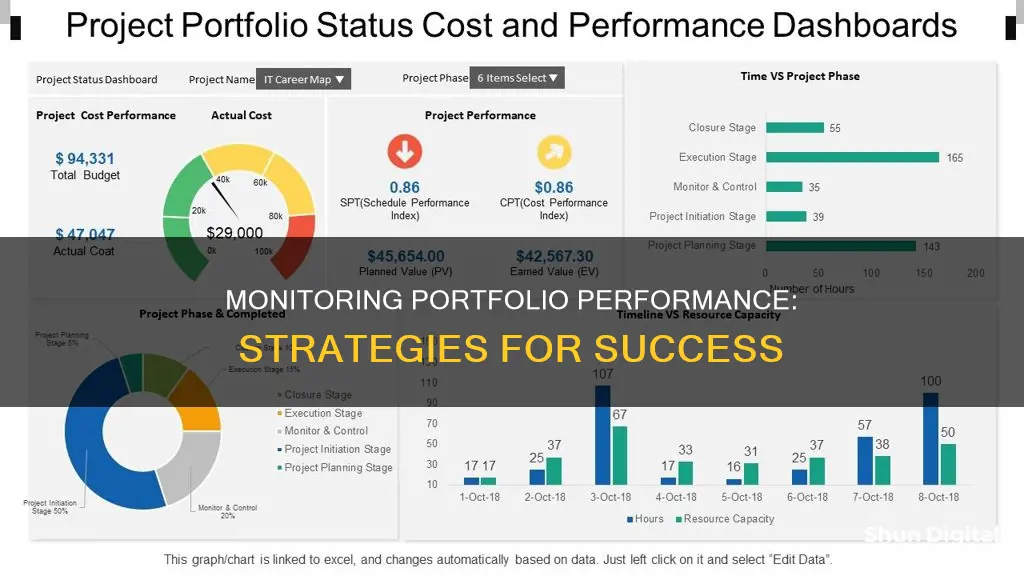

Monitoring your portfolio's performance is essential to ensure your investment strategies are effective and meet your goals. This involves regularly reviewing your portfolio to assess its health and make any necessary adjustments. By tracking your portfolio's performance, you can evaluate the returns generated and the level of risk taken. This allows you to identify areas for improvement and refine your investment strategies over time.

There are several key metrics and considerations for monitoring portfolio performance, including total return, risk-adjusted performance, and benchmark comparisons. It is also crucial to assess individual investments, asset allocation, and future goals to ensure your portfolio aligns with your risk appetite and desired objectives.

By understanding how to monitor your portfolio's performance, you can make more informed and confident investment decisions.

| Characteristics | Values |

|---|---|

| Frequency of evaluation | Regular evaluations are recommended, at least once a year |

| Evaluation period | Long enough to capture a representative sample of the portfolio's performance |

| Data accuracy and quality | Data should be up-to-date and accurate |

| Monitoring time horizon | Depends on investment goals and investment style |

| Monitoring frequency | Quarterly is a common choice |

| Performance metrics | Total return, standard deviation, Beta, R-squared, Sharpe ratio, Sortino ratio |

| Benchmark comparison | S&P 500, Barclays US Aggregate Bond index, Vanguard Balanced Index (VBIAX) |

What You'll Learn

Annualised total performance

Monitoring your portfolio's performance is an essential aspect of the investment process. It allows investors to assess the effectiveness of their investment strategies and determine whether their chosen strategy is achieving the desired risk and return objectives.

One of the key metrics for performance monitoring is the annualised total return, also known as the compound annual growth rate (CAGR). This is the geometric average amount of money an investment earns each year over a given period. It is calculated as a geometric average to show what an investor would earn over some time if the annual return were compounded.

The formula for calculating the annualised total return is:

1 + Return) ^ (1 / N) - 1 = Annualised Return

Where N = the number of periods measured

To accurately calculate the annualised total return, you will first need to determine the overall return of an investment. This can be done using the following formula:

Ending value - Beginning value) / Beginning value

The beginning value is the value of your portfolio when you invested or the amount you initially put into the investment. The ending value is the value of your portfolio at the end of the period you are evaluating.

Once you have calculated the overall return, you can use this value to calculate the annualised total return. In the formula, the "1" that is divided by "N" in the exponent represents the unit of time being measured (e.g. one year). You can also use "365" instead of "1" to calculate the daily return of an investment. The "N" in the formula represents the number of periods being measured. For example, if you are calculating the annualised total return over a period of five years, you would use "5" for the "N" value.

It is important to note that the annualised total return provides only a snapshot of an investment's performance and does not account for any potential price fluctuations or negative changes. Therefore, investors often consider other risk measures, such as standard deviation, in addition to the annualised total return when evaluating their portfolio's performance.

Monitoring Resource Usage: Strategies for Optimal Performance

You may want to see also

Review individual funds

Reviewing individual funds is a crucial step in monitoring your portfolio's performance. Here are some detailed instructions on how to go about it:

Understand the Importance of Reviewing Individual Funds:

Start by understanding why reviewing your individual funds is essential. Different fund managers perform well in different circumstances, and your position and that of your investments will likely change over time. Regularly reviewing your individual funds helps ensure they are aligned with your financial goals and objectives. It also helps you identify areas that require adjustments to enhance performance and reduce risk.

Set Clear Expectations:

Before reviewing your individual funds, set clear expectations for their performance. You can use methods such as a risk profile-based thumb rule or the 'inflation + X' method to set realistic return expectations based on your risk tolerance and investment horizon. This step will help you assess whether your funds are meeting your goals.

Assess the Performance of Each Fund:

Analyze the returns generated by each fund over a specific period. Compare these returns to appropriate benchmarks, such as market indices or peer groups, to determine if your funds are outperforming or underperforming. Also, consider risk-adjusted performance metrics to evaluate the returns generated relative to the level of risk taken.

Evaluate Fund Characteristics:

Dive into the characteristics of each fund to understand their impact on performance. For example, consider the fund's asset allocation, diversification, and investment strategies. Evaluate the level of risk taken by examining volatility and correlation with the broader market. Additionally, assess the expenses and fees associated with each fund to ensure they are reasonable and aligned with the value provided.

Make Necessary Adjustments:

Based on your review, identify areas where adjustments are needed. This could include rebalancing your portfolio by buying or selling certain funds to align with your target asset allocation. Consider factors such as individual stock or bond performance, fund manager changes, and changes in investment strategies when deciding on adjustments. Remember to also take into account the costs and potential tax implications of any changes.

Monitor Individual Funds Regularly:

Don't make reviewing individual funds a one-time activity. Regularly monitor the performance of each fund to stay on track. The frequency of reviews may depend on your financial situation and investment objectives, but it is generally recommended to conduct reviews at least annually. This helps you identify any issues promptly and make necessary adjustments to keep your portfolio optimized.

The Future of LCD Monitors: When Will They Become Obsolete?

You may want to see also

Evaluate asset allocation

Evaluating asset allocation is a critical aspect of monitoring portfolio performance. It involves assessing whether your investment strategy is achieving the desired risk and return objectives. Here are some detailed instructions on how to evaluate your asset allocation:

- Assess Risk Tolerance: Firstly, it is essential to understand your risk tolerance. Are you a conservative, moderate, or aggressive investor? This will determine the types of assets you should hold in your portfolio. Conservative investors typically focus on capital preservation and stability, while aggressive investors are more experienced and can tolerate higher risk for potential gains.

- Diversification: Diversification is a key concept in asset allocation. By investing in a variety of assets, such as stocks, bonds, and cash, you can balance risk and potential returns. Diversification ensures that your portfolio is not overly exposed to the performance of a single asset class or security.

- Review Individual Assets: Regularly review the performance of each asset in your portfolio. Different assets will perform differently over time, and it is crucial to ensure that each is meeting your expectations. This includes evaluating the impact of sector allocation and security selection on overall performance.

- Monitor Volatility: Volatility refers to the price fluctuations of your investments. Monitoring volatility can be done by calculating the standard deviation of your portfolio's returns compared to a benchmark, such as the S&P 500 for stocks or the Barclays US Aggregate Bond Index for bonds. A higher standard deviation indicates greater price variation and volatility.

- Risk-Adjusted Performance: Evaluate the effectiveness of your portfolio by considering both the returns generated and the level of risk taken. This can be done using metrics such as the Sharpe ratio, Sortino ratio, and Treynor ratio, which measure the excess return per unit of risk taken.

- Rebalancing: As your investments grow or decline in value, your asset allocation will shift. Periodically review and rebalance your portfolio to ensure it aligns with your initial strategy and risk tolerance. This may involve buying or selling assets to return to your desired allocation.

- Time Horizon: Consider your investment time horizon when evaluating asset allocation. For long-term goals, such as retirement, you may be able to tolerate more risk and focus on growth. As you approach your goal, you may need to adjust your allocation to reduce risk and preserve capital.

- Goals and Performance: Regularly assess whether your portfolio is on track to meet your financial goals. For example, if you are saving for a new house, ensure your portfolio is focused on growth rather than income. Review your goals and adjust your asset allocation as necessary.

By following these steps, you can effectively evaluate your asset allocation and make informed decisions to optimise your investment portfolio's performance.

Comforting Friends with Ankle Monitors: What You Can Do

You may want to see also

Compare portfolio performance to a benchmark

Comparing portfolio performance to a benchmark is a common practice in performance evaluation. It allows investors to determine whether their portfolio is outperforming or underperforming the market or its peers, providing valuable insight into the effectiveness of their investment strategy.

Choosing a Benchmark

When selecting a benchmark, it is crucial to choose one with similar risk characteristics and investment objectives as the portfolio being evaluated to ensure a fair comparison. The benchmark should correspond to the investor's investment style and expected returns. For example, the S&P 500 is commonly used as a benchmark for large-cap US stocks, while the Bloomberg Barclays US Aggregate Bond Index is used for bonds.

Calculating Performance

To calculate portfolio performance against a benchmark, investors should first determine the asset allocation of their portfolio, categorising investments into large-cap and small-cap stocks, international stocks, bonds, real estate, and cash. Next, they must identify appropriate benchmarks that match the asset classes in their portfolio. Finally, they can calculate the actual performance of their portfolio and compare it to the benchmark to determine if it met their expected returns and risk tolerance.

Limitations and Considerations

It is important to note that benchmark comparisons have limitations, such as data quality issues, benchmark selection bias, and the risk of overemphasising short-term performance. Additionally, investors should consider the impact of investment fees and taxes on portfolio performance when evaluating against a benchmark.

Qnix Monitors: Which One Should You Choose?

You may want to see also

Monitor the fundamentals of your mutual funds

Monitoring the fundamentals of your mutual funds is a crucial aspect of portfolio management. Here are some detailed instructions to help you monitor the fundamentals effectively:

Establish Your Investment Criteria

Firstly, outline your investment criteria in an Investment Policy Statement (IPS). This document should encompass your investment goals, objectives, and the specific metrics you'll use to monitor performance. It should also include investment selection criteria and guidelines for replacing underperforming investments. By having a clear IPS, you can ensure that your mutual funds remain aligned with your investment strategy.

Watch for Unexpected Changes

Keep a close eye on your mutual funds, just as you would monitor your overall portfolio. Compare the current characteristics of your mutual funds with the criteria set out in your IPS. If a fund no longer meets most of your criteria, consider whether it still belongs in your portfolio. Remember, a fund that no longer meets one or two criteria may not be a cause for immediate concern, but consistent underperformance against your criteria may be a sign to consider selling.

Analyse Performance

Evaluate the performance of your mutual funds by comparing them with relevant benchmarks, such as market indices or peer groups with similar investment strategies. This will help you determine whether your funds are outperforming or underperforming the market. Additionally, consider evaluating the performance of fund managers. Are they consistently delivering returns that align with the fund's mandate and investment style? Remember to assess both the highs and lows, rather than focusing on short-term fluctuations.

Understand Risk and Return

Assess the level of risk taken by examining the volatility of your mutual funds, which can be measured by the standard deviation or other risk metrics. Also, consider the correlation between the fund's returns and the broader market. Evaluate whether the fund is generating sufficient returns for the level of risk taken. You can use tools like the Sharpe ratio, Sortino ratio, or Treynor ratio to measure risk-adjusted performance.

Evaluate Fund Characteristics

Break down the characteristics of your mutual funds by analysing their strategy (growth or value), median market cap, rolling returns, standard deviation, and portfolio breakdown by sector or region. This will help you understand the underlying drivers of the fund's performance and potentially uncover opportunities for higher profits. Additionally, consider the fund's sensitivity to market movements in both up and down markets, which can be assessed using up-market and down-market capture ratios.

Consider External Factors

Don't forget to evaluate external factors that can impact fund performance, such as market and economic cycles. Changes in the overall economic conditions can affect capital markets and disturb the asset allocation of your portfolio, increasing the risk profile beyond your comfort level. Therefore, periodic rebalancing of your mutual fund portfolio may be necessary.

By following these steps, you can effectively monitor the fundamentals of your mutual funds and make more informed investment decisions. Remember to stay vigilant and adapt your strategies as needed to align with your investment goals.

Finding the Perfect Monitor Match: Equivalents for Your Setup

You may want to see also

Frequently asked questions

It is recommended to review your portfolio at least annually. However, the frequency of evaluation depends on factors such as investment objectives, time horizon, and market conditions.

Some common key performance metrics include absolute return measures such as total return and compound annual growth rate (CAGR), risk-adjusted return measures like Sharpe ratio, Sortino ratio, Treynor ratio, and Jensen's alpha, and performance attribution metrics, which analyse sector allocation, security selection, and interaction effects.

To calculate your portfolio's return, subtract its value at the end of the year from its value at the beginning of the year. Then, divide the difference by the initial value and multiply by 100 to get the percentage gain.