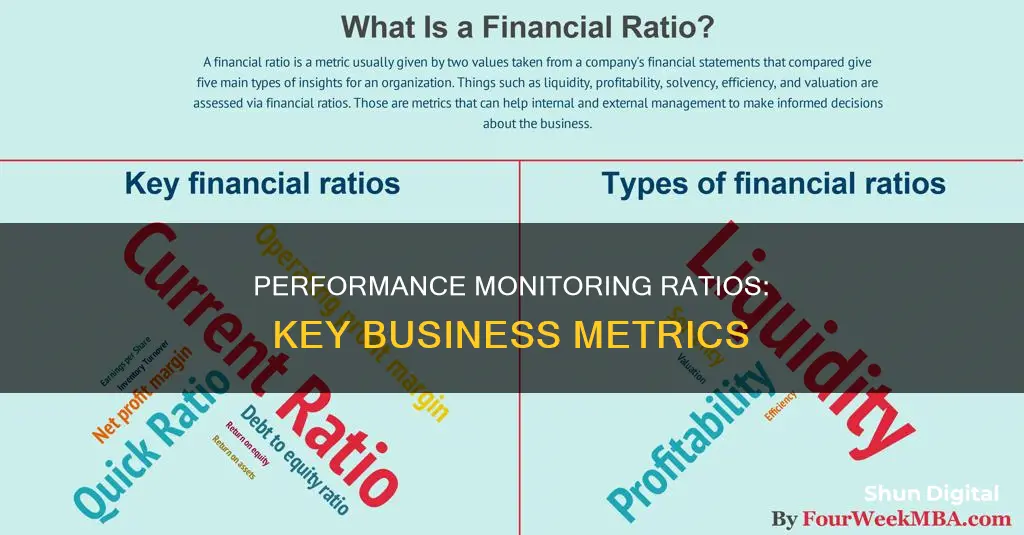

Financial ratios are a cornerstone of fundamental equity analysis. They are used to gain meaningful information about a company's financial health and viability. Financial ratios are calculated using data from a company's financial statements, including the balance sheet, income statement, and cash flow statement. These ratios can be used to monitor a company's performance over time, make comparisons with competitors, and assess its financial stability and potential future growth. While there are many different financial ratios, they can be broadly categorized into liquidity ratios, leverage ratios, efficiency ratios, profitability ratios, and market value ratios.

What You'll Learn

Liquidity ratios

There are three main types of liquidity ratios: the current ratio, the quick ratio, and the cash ratio. The current ratio is the simplest to calculate and interpret, as it uses all current assets in the calculation. The quick ratio is a stricter test of liquidity, excluding inventory and prepaid expenses from the calculation. The cash ratio is the strictest test, considering only a company's most liquid assets: cash and marketable securities.

An ideal liquidity ratio is 1, indicating that a company can pay off all its current liabilities with its current assets. A ratio of less than 1 suggests that a company is unable to satisfy its current liabilities, while a ratio greater than 1 indicates that a company can cover its current liabilities, with a higher ratio indicating a greater ability to do so. However, a very high liquidity ratio may suggest that a company is holding too much cash or liquid assets, which could be better deployed to generate returns for shareholders.

Identifying Monitor-Graphics Card Connections

You may want to see also

Solvency ratios

The main types of solvency ratios include:

- Debt-to-Equity (D/E) Ratio: This ratio indicates how much of a company's operations are funded by debt compared to equity. A higher ratio suggests a higher risk of default.

- Debt-to-Assets Ratio: This ratio measures a company's total debt relative to its total assets, indicating its ability to pay off debt with its available assets.

- Interest Coverage Ratio: This ratio assesses a company's ability to cover interest payments with its available earnings. A higher ratio is preferable, as it indicates a greater margin of safety.

- Equity Ratio: This ratio shows how much of a company is funded by equity rather than debt, with a higher ratio indicating stronger financial health.

When interpreting solvency ratios, it is important to consider the industry context and compare a company's ratios to those of its competitors. A high debt-to-equity ratio, for example, may be common in certain industries due to their capital-intensive nature. Additionally, solvency ratios should be used in conjunction with other financial metrics to gain a comprehensive understanding of a company's financial health.

How Multiple Monitors Affect GPU Performance

You may want to see also

Profitability ratios

There are several types of profitability ratios, including:

Gross Profit Margin: This is the amount of money a company has left after paying all the direct costs of producing or purchasing the goods or services it sells. The higher the gross profit margin, the more money the company can afford for its indirect costs and other expenses like interest. The formula for calculating this is:

> Gross profit margin = [ ( Revenue - Cost of goods sold ) / Revenue ] x 100

Net Profit Margin: This reveals the amount of profit a company is taking in, usually after taxes, relative to its sales. A company with a higher net profit margin than its competitor is usually more efficient, flexible, and able to take on new opportunities. The formula for this is:

> Net profit margin = ( Net income / Revenue ) x 100

Return on Assets: This ratio divides net profits by the total amount of assets on the balance sheet. The higher the ratio, the better the company is at producing profits relative to its assets. The formula is:

> Return on assets = ( Net income / Assets ) x 100

Return on Equity: This ratio divides net profits by the total amount of equity on the balance sheet. It can be improved by funding a larger share of operations with debt and using debt to buy back shares, thereby minimising the use of equity. The formula is:

> Return on equity = Net income / Equity

Operating Profitability Ratio: This ratio determines how well a company can generate sales revenue after deducting the cost of goods sold. The formula is:

> Operating Profitability Ratio = Net Income/Sales

Contribution Margin Ratio: This ratio subtracts all variable expenses in the income statement from sales, then divides the result by sales. It is used to determine the proportion of sales still available after all variable expenses to pay for fixed costs and generate a profit. The formula is:

> (Sales - Variable expenses) ÷ Sales = Contribution margin ratio

Net Profit Ratio: This ratio subtracts all expenses in the income statement from sales, then divides the result by sales. It determines the amount of earnings generated in a reporting period, net of income taxes. The formula is:

> (Net profit ÷ Net sales) x 100 = Net profit ratio

It is important to note that profitability ratios are just one aspect of a business's financial situation and should be used in combination with other financial information for a comprehensive understanding.

Monitoring Linux Server Performance: Key Metrics and Methods

You may want to see also

Efficiency ratios

- Inventory Turnover Ratio: This ratio measures a company's ability to manage its inventory efficiently and provides insight into its sales. It is calculated by dividing the cost of goods sold by the average inventory. A high inventory turnover ratio indicates that a company is selling its inventory quickly, while a low ratio may suggest that inventory is being held for too long.

- Asset Turnover Ratio: This ratio measures a company's ability to efficiently generate revenue from its assets. It is calculated by dividing a company's revenue by its total assets. A higher asset turnover ratio indicates that a company is using its assets more efficiently.

- Receivables Turnover Ratio: This ratio measures how efficiently a company can collect debts and extend credit. It is calculated by dividing a company's net credit sales by its average accounts receivable. A higher receivables turnover ratio relative to peers is considered favourable as it indicates greater efficiency in collecting accounts receivable.

- Accounts Payable Turnover Ratio: This ratio represents the average number of times a company pays off its creditors during an accounting period and serves as a measurement of short-term liquidity. It is calculated by dividing a company's net credit purchases by its average accounts payable. A higher payable turnover ratio is desirable as it enables a company to hold cash for longer and improve its working capital position.

- Total Asset Turnover Ratio: This ratio measures how efficiently a company uses its assets to generate revenue. It is calculated by dividing revenue by the average of beginning and ending total assets for a particular period. A higher total asset turnover ratio indicates better performance.

LCD Monitors: Virtual or Real Image?

You may want to see also

Market prospect ratios

- Earnings per share (EPS)

- Dividend payout ratio

- Price-to-earnings ratio (P/E ratio)

- Dividend yield ratio

These ratios are helpful for investors to predict stock prices in the future based on current earnings and dividend measurements. For example, a downward trend in earnings per share and dividend yield points to profitability problems and could even raise going concern issues, indicating a lower stock evaluation.

Finding the Perfect Studio Monitor Sweet Spot

You may want to see also

Frequently asked questions

Liquidity ratios indicate a company's ability to pay off its debts, whereas solvency ratios compare debt levels with assets, equity, and earnings to evaluate the company's financial stability.

Efficiency ratios, also known as activity ratios, evaluate how well a company uses its assets and liabilities to generate sales and maximise profits.

Profitability ratios indicate a business's financial viability by demonstrating how it generates profits from its operations.

Ratio analysis can be used to evaluate a company's performance over time, estimate its future performance, and compare it to other businesses in the same industry.